【PADM5755】finance math

Compound interest is the most powerful force in the universe. Albert Einstein (maybe)

In Week 1 (January 22) we will cover the fundamentals of “finance math”, including several quantitative tools that we will be using throughout this course. These tools include net present value (NPV), internal rate of return (IRR), and amortization (PMT). Read the following to

acquaint yourself with the concepts underlying these tools.

. Chapter 10-The Valuation of Future Consequences: Discounting, A Primerfor Policy Analysis, Stokey and Zeckhauser (Norton 1978). Available on Canvas.

A key concept to keep in mind:

“ …interest rate and discount rate are different names for what is arithmetically the same thing. It is customary, however, to use the two terms in different contexts. When we start with a sum of money and calculate earnings on it forward into the future, we speak of the interest rate. When we start with a given sum at some time in the future and calculate

back in time to the present to determine the present value, we speak of the discount rate. As far as the arithmetic is concerned it’s almost a distinction without a difference.”

Source: A Primerfor Policy Analysis, p. 161.

. Pp. 9- 13 and 17-47 of the Principles ofFinance with Excel, Simon Benninga, (Oxford University Press 2011). Available on Canvas.

Note: There is a lot of jargon in finance; below is a link to a useful reference: http://www.msrb.org/glossary.aspx

To give you some practice with these concepts, I want you to complete the homework

assignment below using Excel. Please submit your assignment to the Canvas website by 9:00pm on Sunday, January 28. (Note; there is an "Assignments" tab on the Canvas site labelled with the due date for each assignment.) Feel free to consult with other class members on the assignment, but submit your own homework. During class on January 29, we will review the homework to ensure that everyone is up to speed. (Note: While I log in the homeworks that are submitted, I do not grade them; it is your responsibility to self-evaluate your work. I will provide a homework “solution” against which you can compare your work.)

The exercises below use as their basis the Rail Park project described in the pre-start memo which is posted on Canvas. (Note: I have added/made up some additional details for the

purposes of the homework assignment.)

This project, which is in the conceptual stage, entails the conversion of an abandoned rail viaduct in Center City Philadelphia into a public urban park similar in nature the High Linein New York City. The capital cost of the project (for the least ambitious option) is $62 million.

1. Problem # 1—As a matter of practice, the Philadelphia Department of Planning and

Development conducts a cost benefit review of discretionary public investments. The purpose of this review is to determine whether the investment is justified in terms of its anticipated benefits.

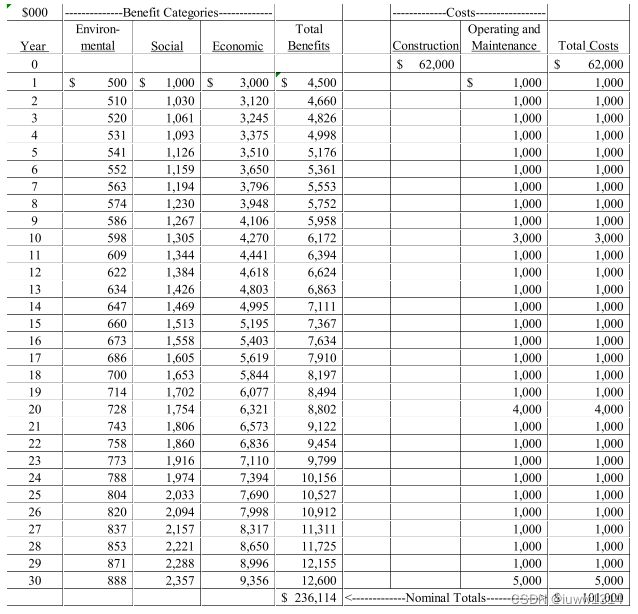

Using the High Line as a guide, expected benefits from the Rail Park fall into three primary categories;

. Environmental—sequestering carbon and mitigating rain runoff . Social—increased visitors, promote healthy activities

. Economic—increased tax revenue and promoting commercial and housing development

Source: High Line | Landscape Performance Series

Using these categories, the Planning Department has estimated the benefits associated with the Rail Park and the costs of construction and ongoing maintenance—see below. (Note: Regarding the numbers, the convention that is commonly used in the finance

world and which we will follow is that Year 0 is today and Year 1 is the end of the first year. In the table below we show the construction costs occurring today, which while unrealistic, is a good simplifying assumption. The benefits and costs that are realized in Year 1 “show up” at the end of year 1.)

The nominal totals above suggest that benefits far outweigh the costs. We know, however, that costs and benefits out into the future should be present valued (discounted) back to

today to allow for a true comparison. Using a 4.7% discount rate (which is the discount rate mandated by the US Office of Management and Budget (OMB), determine whether this project “makes sense” . In other words, is the net present value (NPV) of the benefits greater than the NPV of the costs.

Question: Are there other costs the City should consider before making a decision?

2. Problem #2— Cherelle Parker, Philadelphia’s recently inaugurated mayor, wants

to know how much money the City would pay annually in debt service if 100% of the project’s construction cost is financed with a general obligation loan. The Mayor would also like to know the annual breakout of principal and interest payments on the loan.